Inclusionary Housing

The City requires all new residential developments with 50 or more housing units to sell at least 10% of their units at an affordable price for low- to moderate-income residents. Homeowners can earn equity on the property while the homes remain affordable for a minimum number of years before they can be sold at market rate. Prospective buyers may qualify for down payment and closing cost assistance. For more information, contact the Tallahassee Lenders' Consortium at 850-222-6609 or email kmiller@tallahasseelenders.org.

Eligibility

Total household income must be 100% of the area median income (AMI) or less, adjusted for family size, as defined by the U.S. Department of Housing and Urban Development. Applicants must demonstrate proof of income.

Exclusive new Portland model now available in the Canopy community!

New Home Infill Program

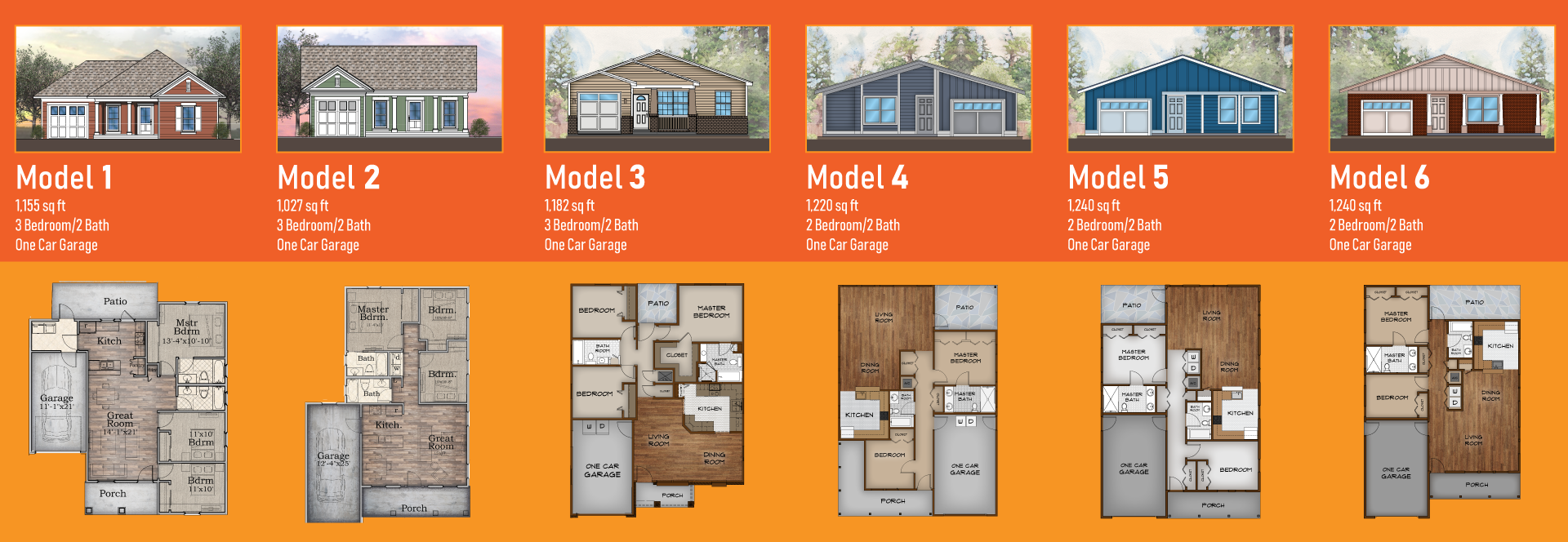

The New Home Infill Program, developed at the direction of the Community Redevelopment Agency (CRA) Board, is designed to help alleviate the shortage in availability of housing and provide a pathway to home ownership for low to moderate-income residents of Tallahassee. The CRA Board commissioned the six house plans below to fit into the aesthetic of established neighborhoods. In addition, the City also contracts to build new homes on infill lots using these and similar plans through its work with CHDO's, the CLT, and local contractors. Incentives to developers and homebuyers are available in connection with the purchase of the newly built home

Click the image to see a larger view.

Multiple lots have already been identified and are highlighted on the map linked below.

Designated New Home Infill and CLT Lots Map

If you would like to find out more information about how the City's new construction projects might be right for you, please fill out the contact form below or email the City's Housing division.

Contact Form

Down Payment Assistance

The City offers down payment and closing cost assistance to help low-income residents to purchase an affordable home and to start a path towards building equity and wealth. The program is administered by the Tallahassee Lenders' Consortium (TLC) on behalf of the City. TLC also provides homebuyer education, credit and finance counseling and assistance in selecting a mortgage lender.

Eligibility

Total household income must be 80% of the area median income (AMI) or less, adjusted for family size, as defined by the U.S. Department of Housing and Urban Development. Applicants must demonstrate proof of income, be approved for a first mortgage through a qualified lender and attend TLC's homebuyer education classes. The total amount of DPA will be determined based on need.

Visit https://www.tallahasseelenders.org/down-payment-assistance.html to learn more. Interested buyers may submit a pre-application through the City's application portal.

Community Land Trust

Tallahassee launched its first Community Land Trust (CLT) in March 2020 in partnership with Leon County and the Tallahassee Lenders' Consortium. A CLT is a nonprofit entity governed by community stakeholders that can build and preserve affordable housing and can help stabilize neighborhoods by reducing the negative impacts of gentrification. In a traditional real estate sale, the owner owns the building and the land it sits on. CLTs keep homes affordable by leasing the land and selling only the house for low- to moderate-income people. Under this model homeowners can earn a portion of the equity on their home and eventually go on to buy a market rate home, while the CLT is able to keep the home affordable for the next owner. Eligible buyers must qualify at or below 80% AMI and be approved for a first mortgage. Down Payment Assistance is also available.

Contact the Tallahassee Lenders' Consortium at 850-222-6609 x100 for more information.

Construction Loan Program

Private developers may apply for a short-term construction loan to build affordable single-family homes (including duplexes, triplexes, and quadraplexes). Loans carry an annual interest rate of below the 'prime rate' as reported by The Wall Street Journal (WSJ). The loans are due and repayable to the City within 18 months from the date of the loan agreement or 6 months following the issuance of Certificate of Occupancy (CO), whichever occurs first.

- Maximum loan of $175,000 per project

- Eligible uses for the funds include construction and major rehabilitation of single-family homes for resale to eligible buyers qualified at or below 100% AMI.

In addition to the loan, the City may offer other incentives to developers such as expedited permitting, and a waiver of water and sewer system and tap fees for homes whose purchasers have been identified upfront and whose income is at or below 80% AMI.

Eligibility

- Must be a private developer or contractor that is licensed and insured to perform such work.

- Must demonstrate capacity to develop affordable single-family housing units and/or experience working with the targeted homebuyers at 100% AMI or less.

- Must submit audited financial statements or financial statements prepared and signed by a Certified Public Accountant to demonstrate capacity to carry the loan and complete the proposed home construction in the event construction costs exceed the maximum $175,000 loan amount.

Applications are received on a rolling basis as funds are available. Apply online through the City's application portal.

Habitat City Build

Since 2017, the City Commission has partnered with the Big Bend Habitat for Humanity to construct affordable homes through a revolving fund supported by the State Community Contribution Tax Credit Program (CCTCP). Tallahassee was one of the first cities to engage in this innovative partnership with Habitat and has since inspired several others across the state. In addition to the financial contribution, City employees and other volunteers have provided hundreds of hours of volunteer labor to build 2-3 homes each year for fellow neighbors in the community.