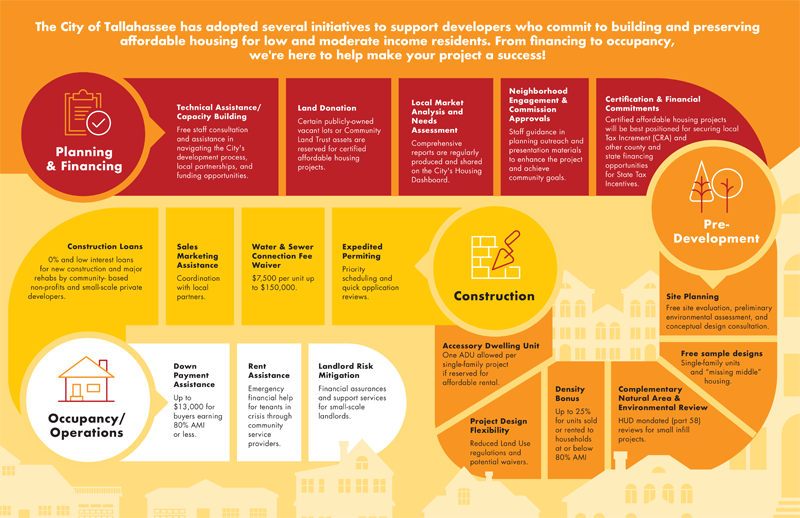

Development Incentives

Click the image to view a full PDF of the process.

Affordable Housing Certification

Developers may have the City certify their proposed projects as affordable housing. Certified affordable housing projects will be best positioned for securing Tax Increment (CRA) and other county and state financing opportunities for State Tax Incentives, as well as local incentives available to affordable housing developments. Please complete the online application and submit to housing@talgov.com.

Affordable Housing Inventory (Real Property)

Per Section 166.0451 of the Florida Statutes, every three years each municipality shall prepare an inventory list of all real property within its jurisdiction, to which the municipality holds fee simple title, that is appropriate for use as affordable housing. The City's resolution and corresponding list of city owned parcels designated as appropriate for affordable housing is available online.

Section 166.0451 further states that properties identified as appropriate for use as affordable housing on the inventory list adopted by the municipality may be used for affordable housing through a long-term lease (requiring development and maintenance of affordable housing), offered for sale and the proceeds may be used to purchase land for the development of affordable housing or to increase the local government fund earmarked for affordable housing, or may be sold with a restriction that requires the development of the property as permanent affordable housing, or may be donated to a nonprofit housing organization for the construction of permanent affordable housing. Alternatively, the municipality may otherwise make the property available for use for the production and preservation of permanent affordable housing.

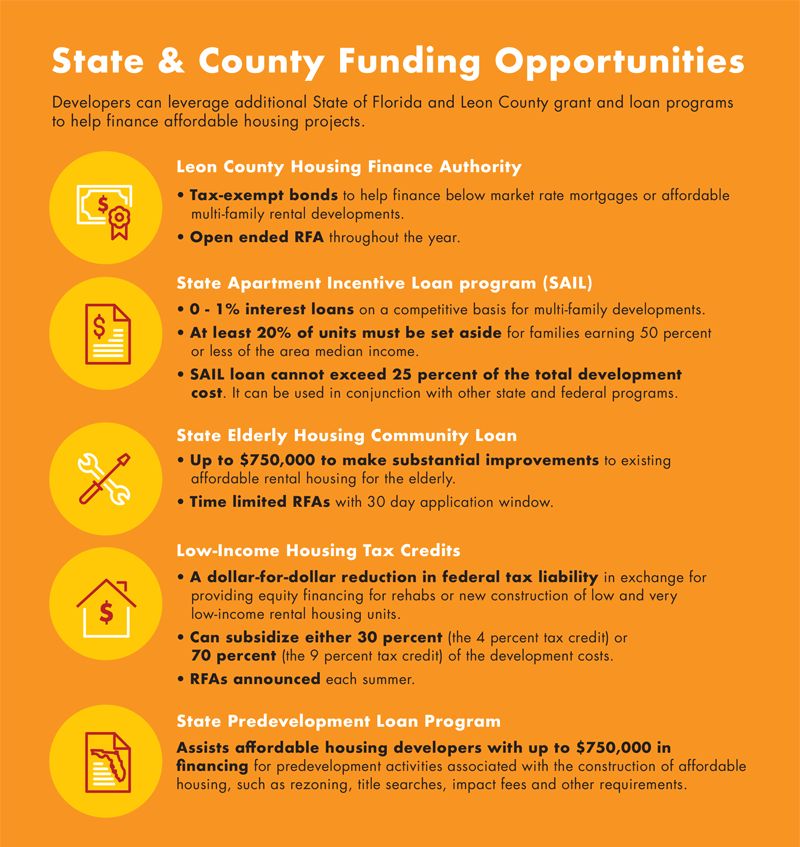

Funding Opportunities

- Infill Housing Construction Loan: Private developers may apply for up to two project loans at a time with a maximum construction loan of $175,000 per project. Loans will carry an annual interest rate of below the 'prime rate' as reported by The Wall Street Journal (WSJ). The loans shall be due and payable to the City within eighteen (18) months from the date of loan agreement or six months following the issuance of Certificate of Occupancy (CO), whichever occurs first. Applications are received on a rolling bases as funds are available in the revolving fund. Apply Online

- Community Housing Development Organizations: The City reserves a portion of its federal funding for Community Housing Development Organizations (CHDOs) to acquire, rehab, or build new affordable housing (ownership or rental). A CHDO is a private nonprofit, community-based organization that has staff with the capacity to develop affordable housing for the community it serves. To qualify for designation as a CHDO, the organization must meet certain requirements pertaining to their legal status, organizational structure, and capacity and experience. The City will also provide technical assistance for non-certified nonprofits to build capacity to become a CHDO. Email us for more information on becoming a CHDO.

Click the image to view a full PDF of the funding opportunities.

Version: 3705 (3/19/2021 11:07 AM) |